Smartr365 was established by a mortgage brokerage who identified an opportunity within the market. They wanted to create a digital product to simplify the mortgage industry. Smartr365 commissioned us to redevelop their MVP and continue to work with our design and development team to accelerate their time to market.

- Lead time:

- 4 months for phase 1 and now on-going

- Sector:

- Fintech

- Target Type:

- B2B

- Demographic:

- Finance Professionals

- Project Goal:

- Industry leading mortgage processing

- Services:

- Web app design, web app development

Smartr365 had been operating using an internal CRM system as an MVP to prove their business case. The system had expanded to fulfil new functional requirements but had become technologically sprawling.

Working with their internal team, we collaborated on re-developing their core software as an API, and delivering a new interface in Angular. We’re continuing to collaborate with Smartr’s development team to rapidly innovate the new version of their web app.

- Scope

- Solution Driven Design

- Adobe XD Wireframes

- Adobe XD Prototypes

- Angular.js Front-end Development

- Quality Assurance

- Resource

- 1x Senior UX Designer

- 1x UI Designer

- 2x Senior Angular.js Developers

- 1x Senior Front-end Developer

- 2x Quality Assurance Testers

- 1x Technical Project Manager

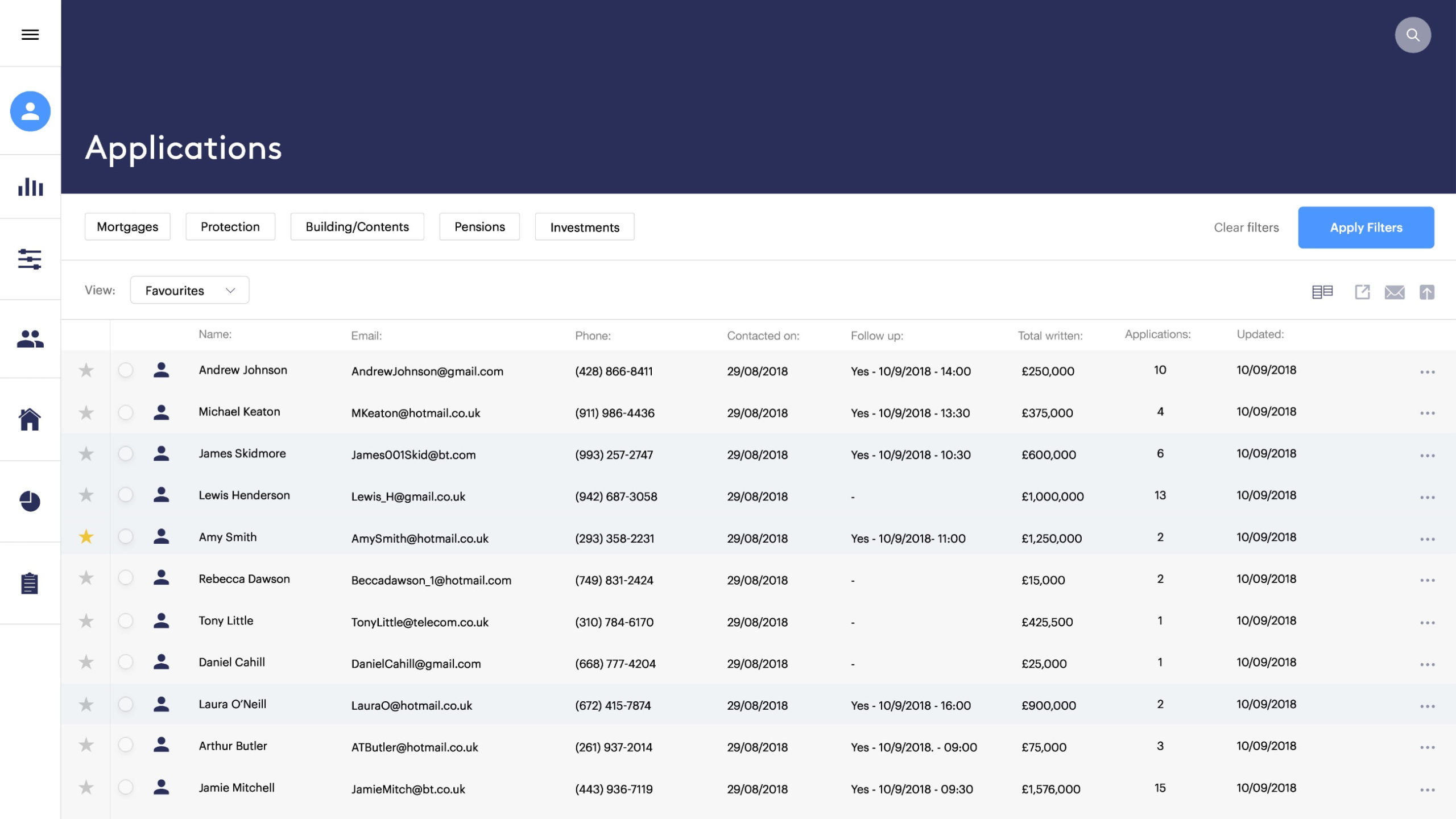

Intuitive custom framework

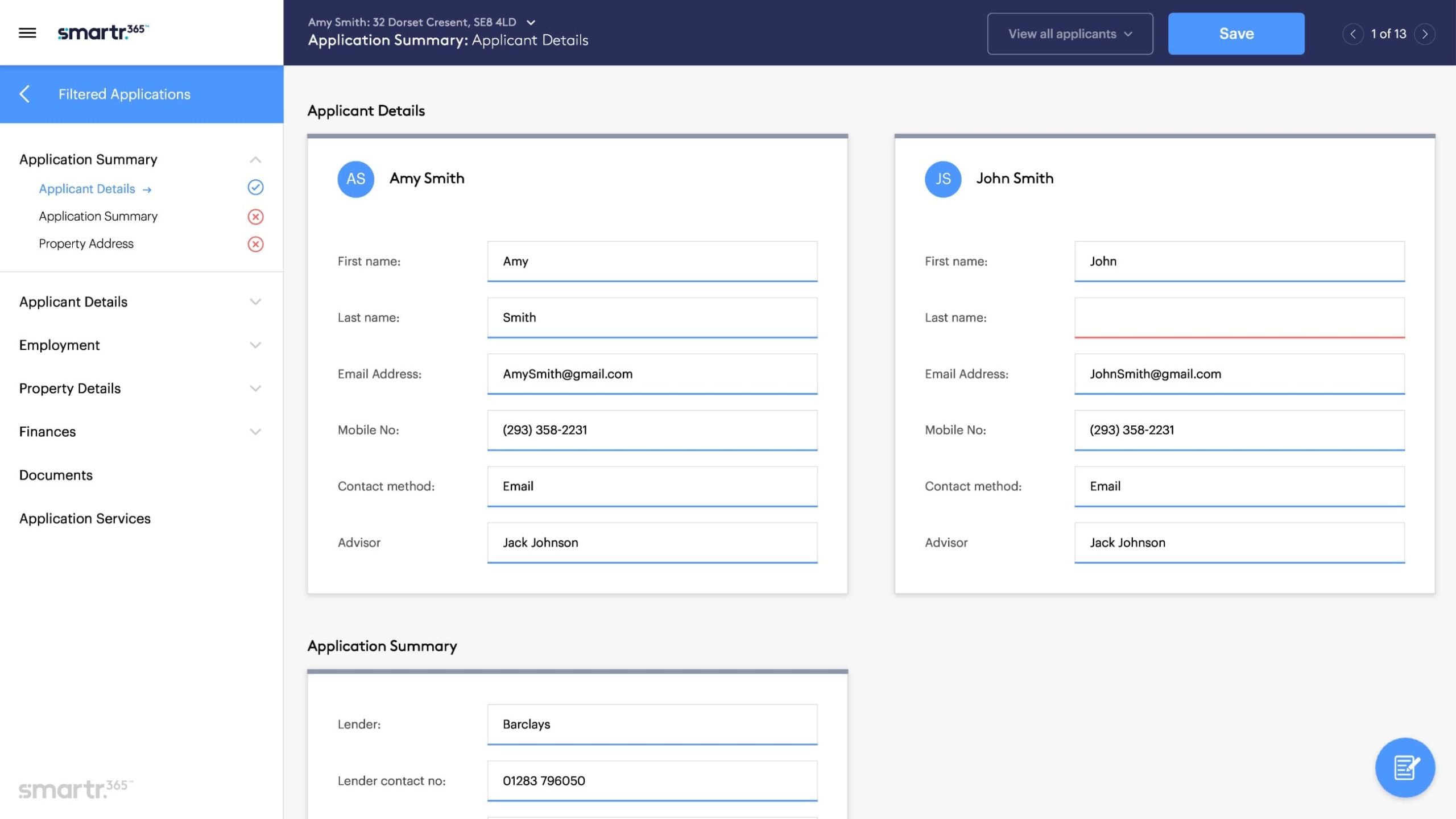

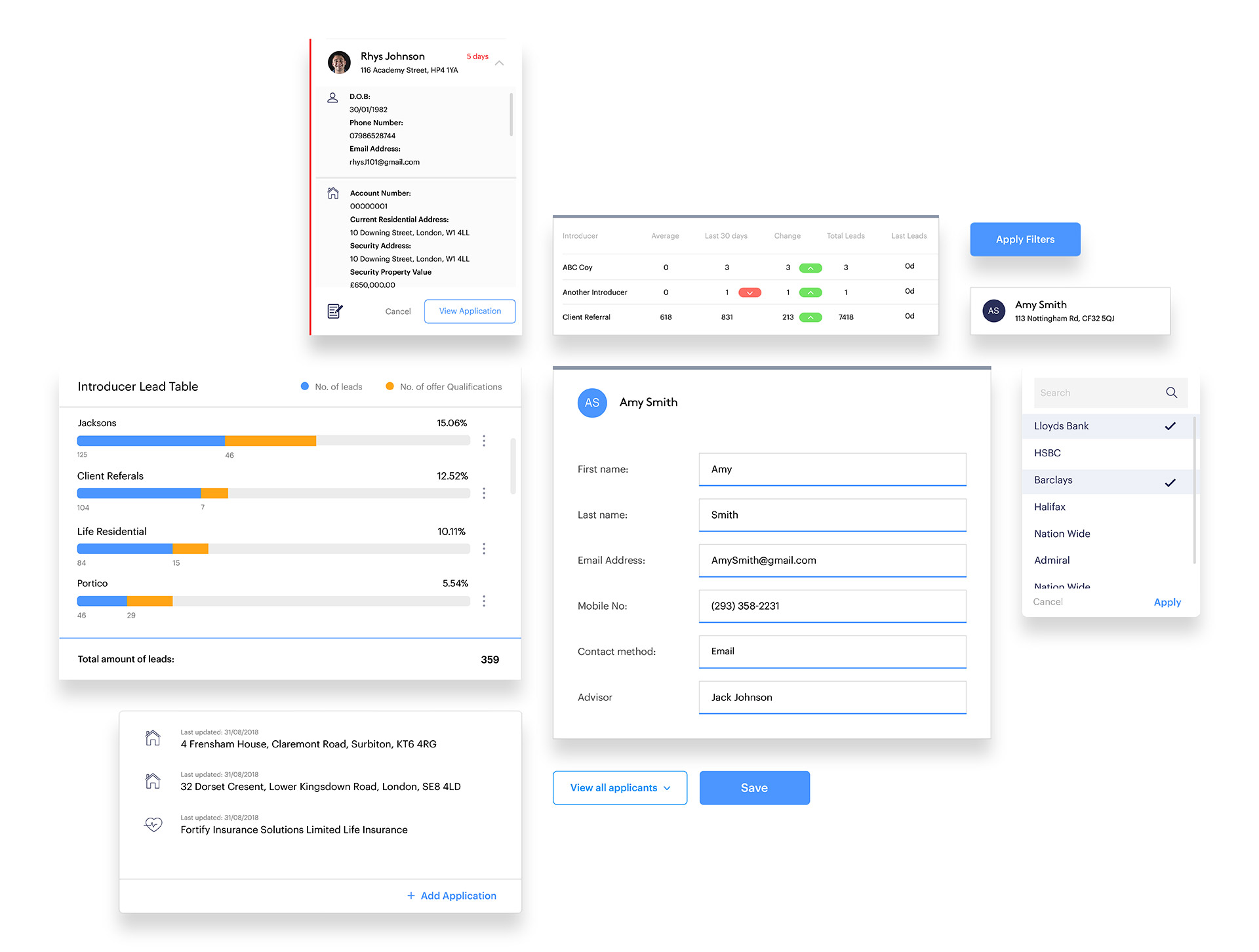

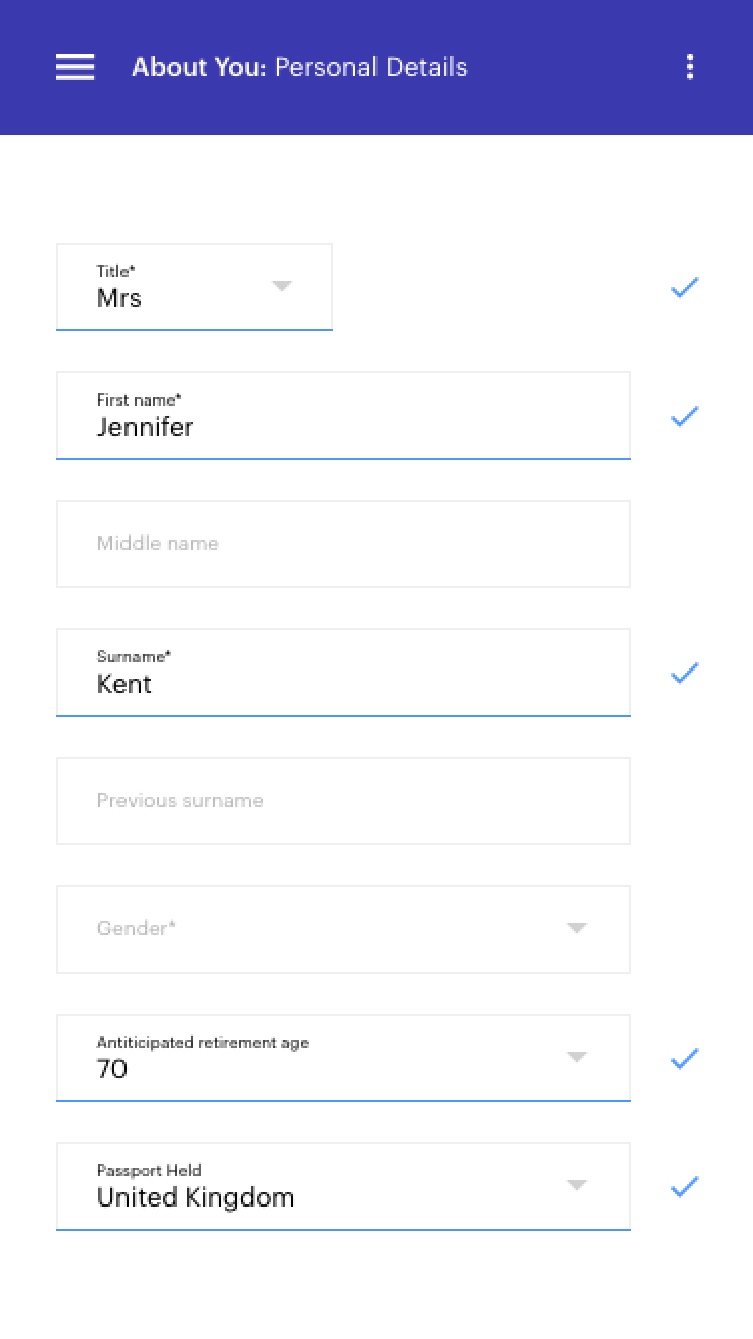

We created a consistent UI framework to be used across the platform, making the system simple to use without training.

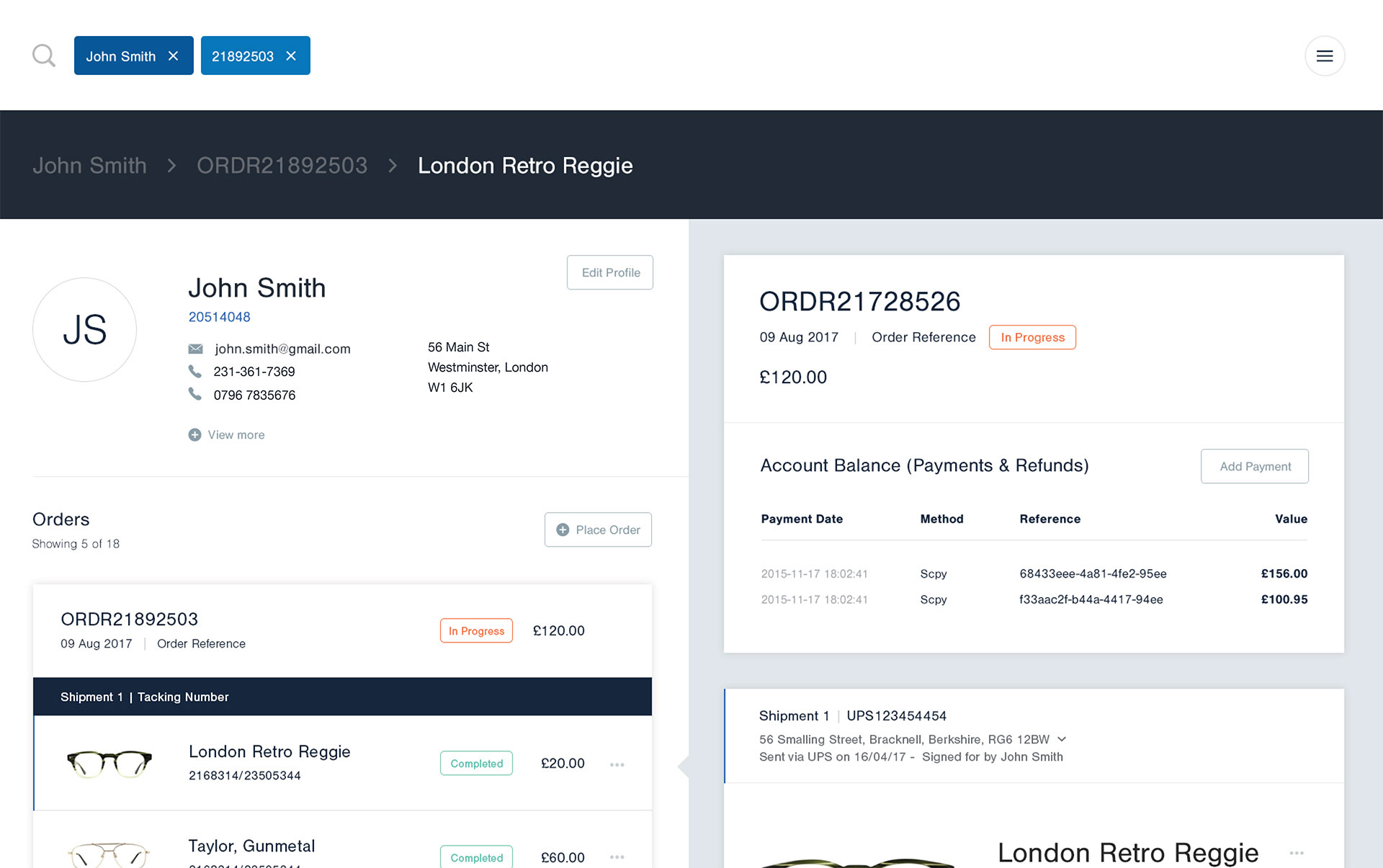

Impactful solutions

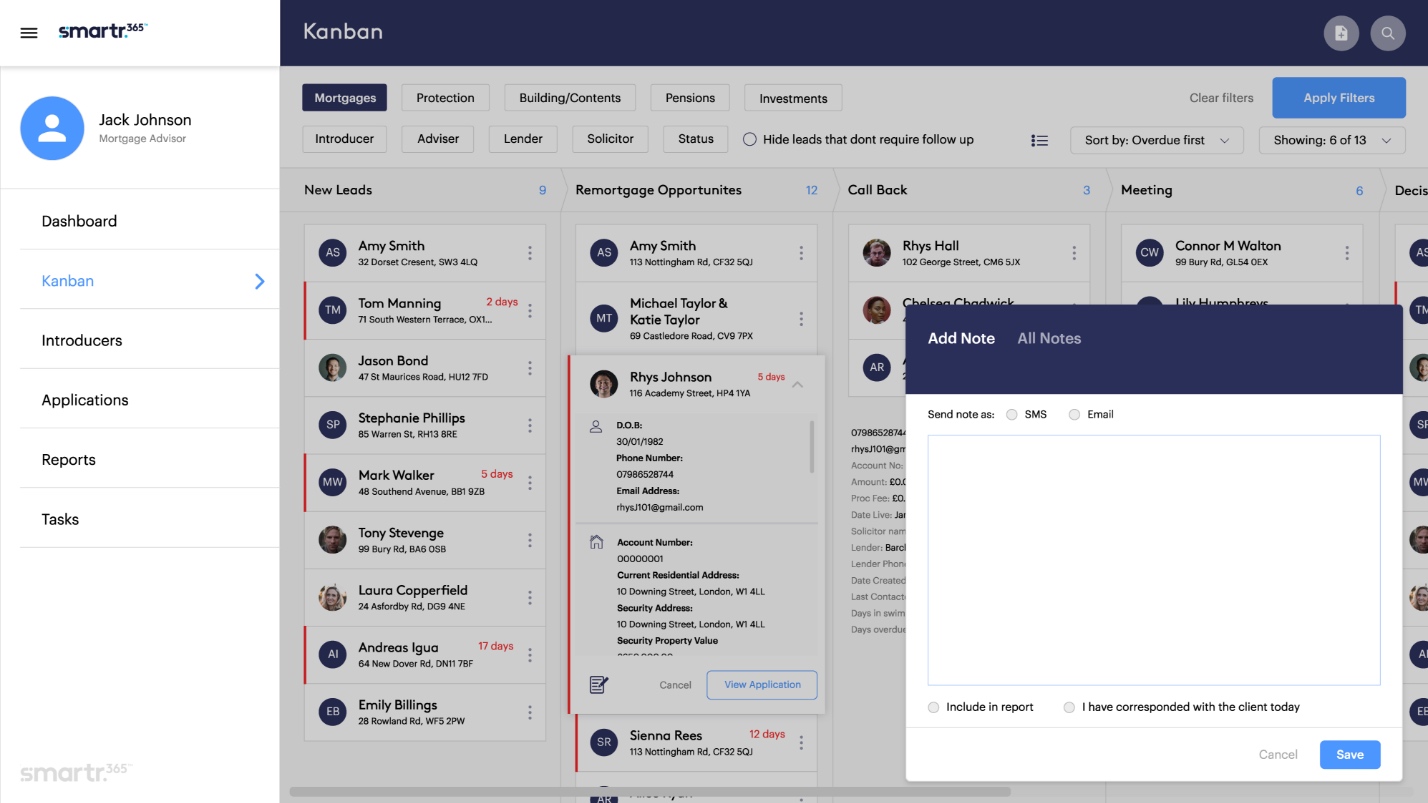

We held focus groups to produce meaningful order management solutions for call centre staff. We delivered a split screen view to remove the need to switch between pages.

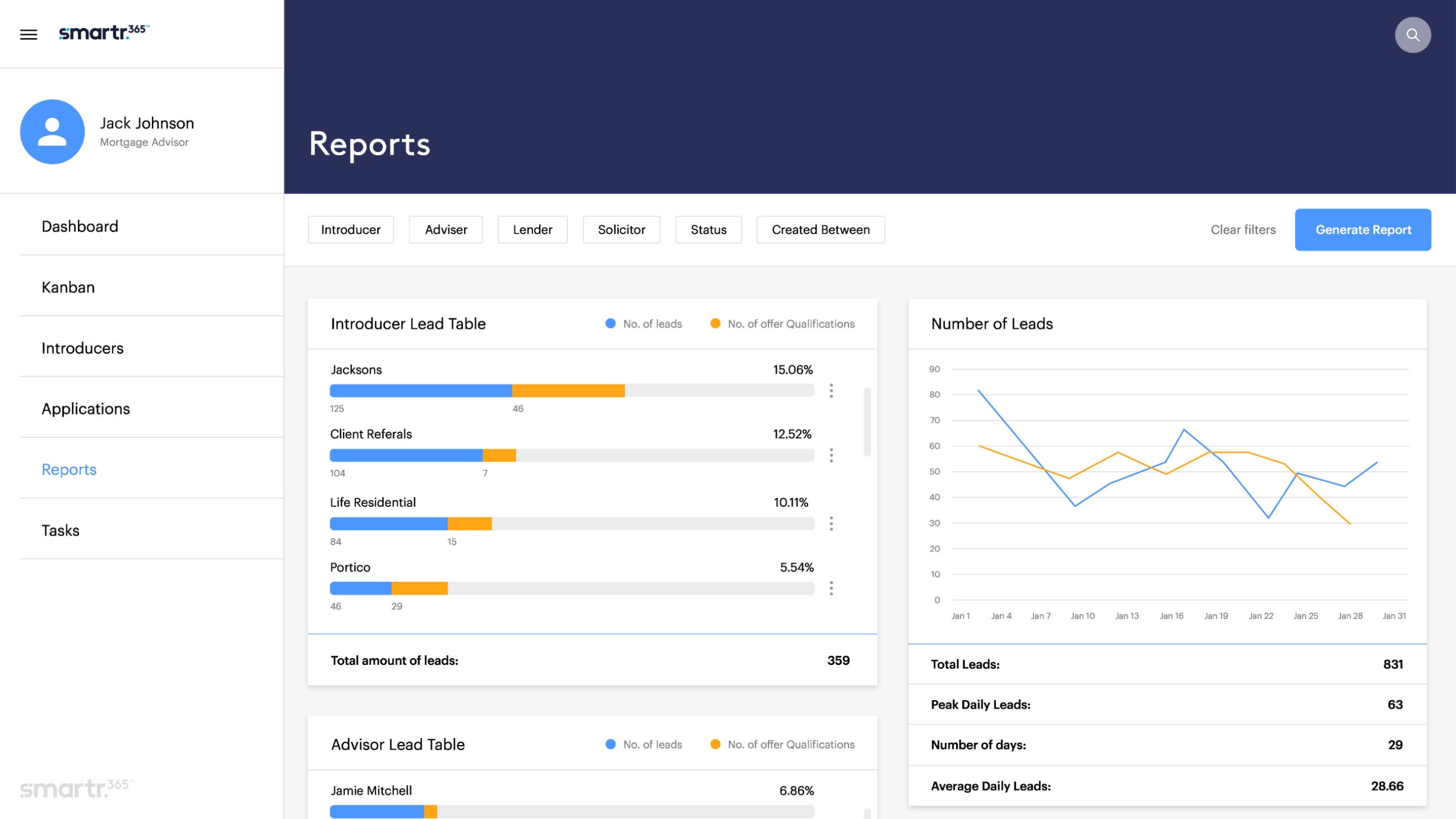

Financial reporting

Smartr365 required complex financial reports to share with mortgage advisory businesses. We displayed these clearly and consistently so they could be shared with industry professionals.

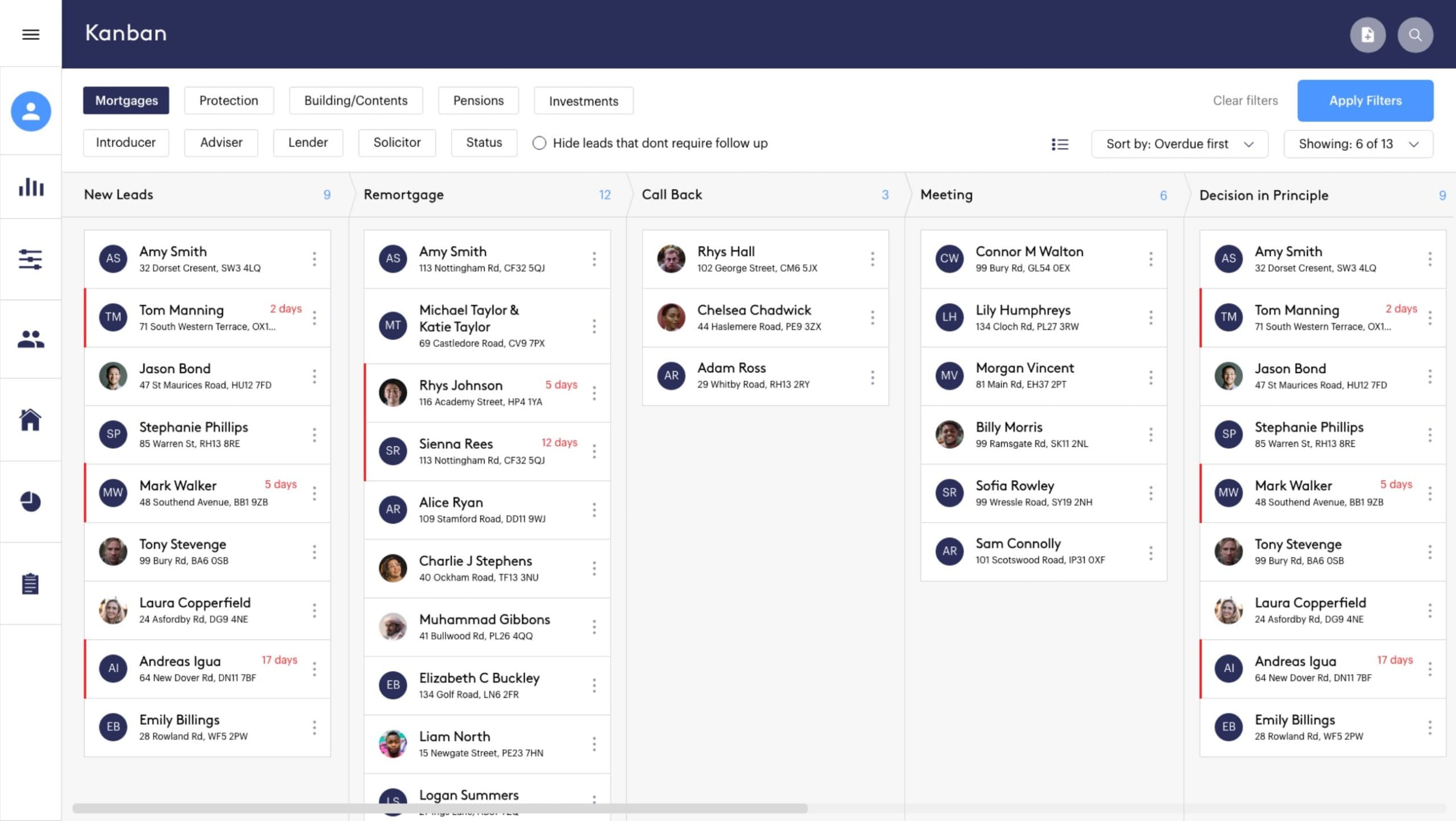

Kanban pipeline

We implemented a kanban pipeline so mortgage applications can be managed more easily by advisors. The custom kanban pipeline allows advisors to quickly edit records on page, enabling them to progress sales to the next stage.

Compliance and validation

Our work flows met tight industry compliance guidelines, ensuring secure validations were made in a streamlined and easy to use manner.

“They really got to grips with our complex financial products, processes and users – highly recommended”

The challenge

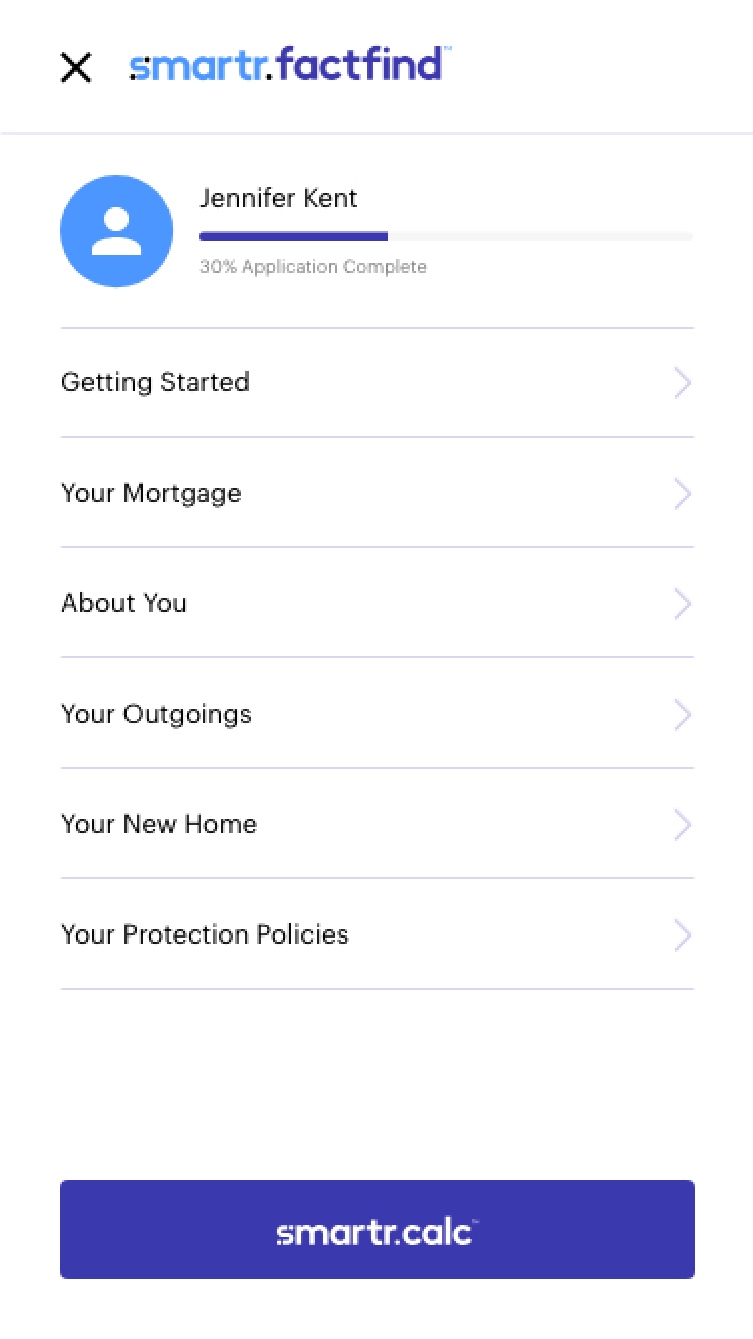

We were engaged to re-imagine the mortgage platform web application to improve user flows and technology stack. The new web application needed to simplify workflows to help mortgage advisors become more efficient.

The Smartr365 platform is used by both mortgage advisors and mortgage applicants. As such, it was critical for the web application to meet the needs of all users, gathering and storing personal and financial information while remaining compliant and secure.